Set Appointment

Property taxes are crucial for funding essential local government services, such as schools, roads, and public safety. Homeowners are required to pay these taxes annually. However, when property taxes are not paid, it can lead to serious consequences, including a property tax sale. This type of sale allows local governments to recover unpaid taxes by either selling a lien on the property or the property itself.

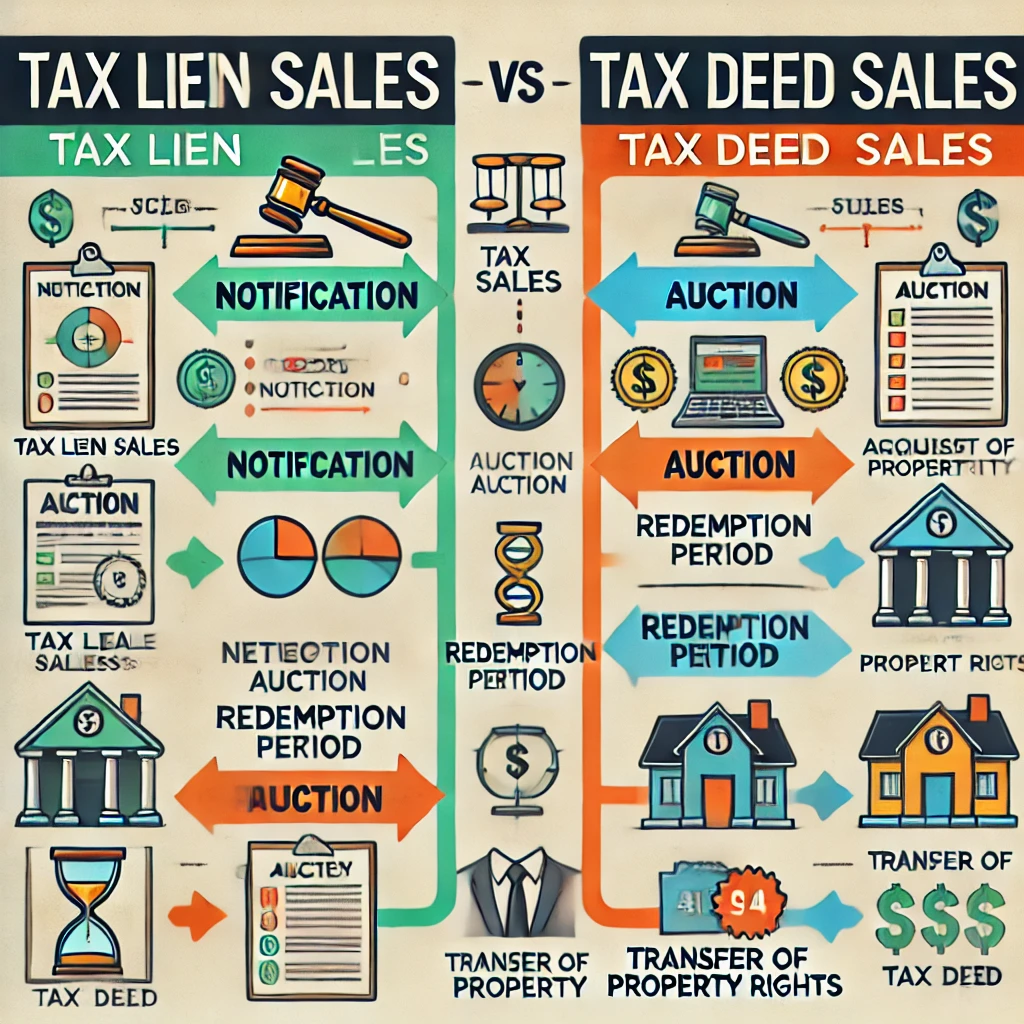

A property tax sale occurs when a homeowner fails to pay their property taxes. There are two main types of property tax sales: tax lien sales and tax deed sales.

Before a property tax sale occurs, the local government takes several steps to inform property owners that they have unpaid taxes. First, they send a series of notices and warnings to make sure the homeowner knows about the overdue taxes. For example, the government might send a letter or even post a notice on the property itself. The timeline leading up to a tax sale can vary depending on the location, but it usually takes several months. During this time, the homeowner has multiple chances to pay the overdue taxes, plus any additional fees or interest, to avoid losing their property.

For instance, if a homeowner has not paid their property taxes for a year, the local government may send three different warning notices over several months. The homeowner can pay the taxes at any point during this time to stop the process. In some areas, the government may even offer a payment plan to help the homeowner catch up on the overdue amount.

Tax sales are typically conducted as auctions, which can be either online or in person. During the auction, potential buyers place bids on either the tax lien or the property itself. The highest bidder wins, and the sale proceeds are used to cover the unpaid taxes.

Tax sales can lead to various legal complications, such as disputes over property ownership or issues related to the property's condition. Buyers must conduct thorough due diligence to understand the risks and any potential liens or debts associated with the property.

Buying property at a tax sale can be an attractive opportunity, as properties may be acquired at a lower price. However, there are risks, including the possibility of inheriting unpaid debts or dealing with property damage. Buyers need to carefully weigh the potential benefits and risks.

Understanding the property tax sale process is essential for both property owners and potential buyers. Failing to pay property taxes can result in the loss of one's home, while buyers need to be aware of the complexities involved. Careful research and consideration are necessary before participating in a tax sale.